Finance teams face growing pressure to do more with less. Manual month-end closes, inconsistent forecasts, and tightening regulatory demands stretch traditional processes to the breaking point. Finance teams are under pressure to move faster, stay accurate, and stay in control—all at once.

Yet many organizations still rely on outdated systems that can’t keep up.

I’m Seema Kutal, a finance transformation leader with over 15 years of experience helping global enterprises use AI to modernize financial operations. Let’s see how Generative AI and Machine Learning can cut hours from month-end close, predict demand more reliably, and stay audit-ready without the scramble.

In this article, I’ll explain how these technologies drive real innovation in finance—highlighting where they deliver the most impact, how to structure them for success, and what leaders need to consider to implement them responsibly.

Where GenAI Moves the Needle in Finance

Generative AI is fundamentally different from traditional AI. While rule-based AI models analyze structured data and automate repetitive tasks, GenAI can create content, predict trends, and enhance real-time decision-making. GenAI’s ability to process unstructured financial data, generate reports, and automate audit processes is already replacing hours of manual work in finance teams every day.

According to the OECD report, most companies started using AI to automate back-office tasks. Now, it powers decisions, flags risks, and supports customers.

As Martin Moeller, Head of AI for Financial Services at Microsoft, explains:

“Generative AI is set to redraw the playbook for how finance teams compete and operate.”

Many financial institutions still struggle to implement AI but are held back by bias, data security, and compliance concerns. But when AI efforts align with real business goals, finance leaders can drive tangible outcomes: faster closes, cleaner audits, and smarter planning.

Both the OECD and Martin Moeller’s quote highlight AI’s shift in finance from automating basic tasks to enabling strategic decision-making, such as risk management and customer support. Moeller emphasizes how Generative AI is streamlining operations and reshaping how finance teams compete, driving efficiency and innovation in a rapidly evolving environment.

Solving Finance’s Biggest Pain Points with AI and ML

While finance has evolved, many processes remain time-consuming and reactive. Organizations use GenAI and Machine Learning to streamline operations, improve forecasting, and enhance risk management. Based on my experience, AI is making the most significant impact here.

Cutting Manual Work That Slows You Down

Traditional finance still takes up hours with reconciliation, invoicing, and compliance reporting. AI automation tackles these tasks at scale—faster and with fewer errors.

Using AI for financial document reconciliation can cut processing time by up to 70%, saving over 800 hours per quarter. Tools like Advanced financial closing cockpit in SAP S/4HANA can automate the month-end close, speeding up reports and compliance checks. AI-powered vendor risk models can flag issues twice as fast as manual audits, enhancing risk management.

Better Forecasting, Fewer Surprises

Finance leaders often struggle with inaccurate forecasts and reactive decision-making. AI-driven predictive analytics can process vast amounts of historical and real-time financial data to generate more accurate predictions.

We integrated SAP Analytics Cloud (SAC) with AI-driven forecasting models at a food processing company, boosting demand and cash flow forecasting accuracy by 30%. They used AI to run what-if scenarios and adjust fast when market conditions changed.

A report by Penner highlights how AI models integrated into SAP environments can improve forecasting accuracy, reduce idle cash by up to 18%, and optimize liquidity planning. These AI tools enable finance teams to make quicker, data-backed decisions in response to changing market conditions.

Risk Isn’t Going Away—But You Can See It Coming

With the rise of fraud, cyber risks, and regulatory compliance challenges, financial institutions require AI-powered solutions to detect anomalies, prevent fraudulent transactions, and ensure audit compliance. AI-driven risk assessment tools can process millions of transactions instantly, flagging potential risks before they escalate into financial losses.

According to SAP’s Insight Viewpoint on Generative AI in Finance, AI helps teams see them coming and act before they occur instead of reacting to risks late.

Together, these insights show how AI is automating routine tasks and empowering finance teams to make more strategic, data-driven decisions. While Penner emphasizes AI’s role in improving cash flow management and forecasting accuracy, SAP’s Insight Viewpoint underscores AI’s proactive approach to risk detection. These sources point to a broader trend of AI driving both efficiency and smarter decision-making in financial operations.

What It Takes to Make AI Work in Finance (Yes, the Tech Matters)

Organizations must have a robust and scalable infrastructure to leverage AI in finance fully. According to the SAP Community Blog on AI for S/4HANA and SAP BTP, the SAP Business Technology Platform (BTP) provides the foundation for integrating AI into SAP environments by combining core AI tools, automation services, and machine learning capabilities.

SAP BTP combines AI Core, AI Launchpad, and embedded AI in SAP S/4HANA Cloud, enabling finance teams to train models, match invoices, predict payments, and flag anomalies—pre-trained services like Document Information Extraction speed up development and improve workflows.

SAP’s integration of AI tools into its platforms like SAP S/4HANA and SAP BTP illustrates the growing trend of AI-driven automation in finance. As organizations embrace these technologies, finance teams are empowered with smarter tools that streamline operations, reduce errors, and enhance decision-making speed. This shift reflects the broader evolution of finance towards more automated, data-driven processes.

Structuring AI for Success: The Right Operating Model

Without a transparent AI model, finance teams risk compliance gaps, wasted spend, and failed pilots.

Many organizations are shifting toward centralized or hybrid operating models to manage these risks and scale AI responsibly. These models establish consistent standards across the business while enabling localized innovation and agility.

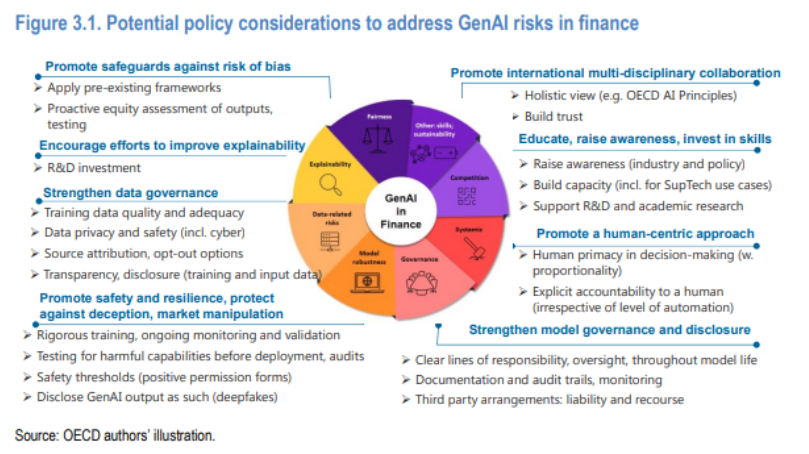

Insights from the OECD’s “Generative AI in Finance” report suggest that success with AI hinges on clear lines of responsibility, robust oversight, and explainability throughout the model lifecycle. Centralized governance helps meet regulatory expectations, manage third-party risks, and ensure AI systems operate ethically and safely in high-stakes financial environments.

From a finance transformation perspective, hybrid AI operating models often deliver the best results. By combining centralized governance with business unit execution, organizations can maintain compliance while enabling agility. This balance helps scale AI effectively across functions without sacrificing control.

As Penner highlights, integrating AI tools into business environments can optimize forecasting and liquidity planning, supporting more accurate, data-driven decisions. This is especially important in hybrid models where consistency and flexibility must coexist.

Ultimately, the right AI model depends on organizational structure, risk appetite, and regulatory needs. A centralized or hybrid approach is often the best way to maintain consistency, security, and long-term AI success.

The OECD and Penner emphasize the importance of combining clear governance with AI integration for success in finance. While the OECD highlights the need for centralized or hybrid models to ensure compliance and oversight, Penner underscores how AI enhances forecasting accuracy and decision-making.

Together, these insights suggest that strong governance frameworks, when paired with AI-driven tools, can optimize financial operations, balancing consistency with flexibility to achieve scalable success

Addressing the Risks You Can’t Ignore

As finance organizations adopt GenAI, managing associated risks is critical. Poorly governed AI can amplify bias, violate data privacy, or fail to meet regulatory standards. Without the proper safeguards, the consequences can be severe—both reputational and financial.

| Risk | Challenges | Mitigation |

| Bias in AI Models | Reinforces unfair lending or scoring decisions. | Regular audits, explainable AI, and human oversight. |

| Data Privacy Concerns | Risk of exposing sensitive customer information. | Use secure, private cloud, or on-premise models. |

| Regulatory Uncertainty | Inability to justify AI decisions. | Implement traceable and auditable AI frameworks. |

Most bias comes from past data. Teams need to audit regularly—and use tools that explain why AI made a choice. Human review still matters.

Compliance and transparency are equally important. In one AI-powered fraud detection project I led, our team used SAP BTP’s AI transparency tools to meet audit requirements. Regulators had complete visibility into the AI-generated alerts and how the system flagged them, ensuring accountability and confidence in the system.

Data privacy must be a top priority. Financial AI models often process highly sensitive information, so deploying them in secure environments—with encryption and access controls—is non-negotiable. Following principles like those from the OECD ensures AI use remains responsible and aligned with regulatory expectations.

Building AI with Purpose and Trust

Transforming with AI requires more than tools—it requires a mindset. I’ve led cross-functional teams across regions, bringing together finance, IT, compliance, and operations to build responsible, explainable systems with real-world impact. I also mentor through the Women in Tech and SAP programs, helping the next wave of leaders rise.

Or, as JPMorgan Chase CEO Jamie Dimon puts it—those who wait will be left behind.

“The future belongs to those who can rise above the technology and master it.”

Finance won’t be reactive much longer. It’s shifting toward real-time, predictive, and intelligent systems. GenAI and ML aren’t nice-to-haves—they’re must-haves. But impact only comes when leaders:

- Choose the right AI model

- Put strong governance in place

- Upskill teams

- Build on secure, scalable platforms like SAP BTP

- Prioritize explainability as much as efficiency

I’ve seen the difference when finance teams get it right—whether automating reconciliations or forecasting cash flow confidently. This is the inflection point.

About the Author

Seema Kutal is a finance transformation leader with 15+ years of experience delivering global SAP S/4HANA and Central Finance projects. She specializes in applying AI and machine learning to modernize financial operations, improve forecasting, and strengthen compliance. Seema is also an active mentor in Women in Tech and SAP leadership programs, focusing on building scalable, high-impact finance solutions.

References:

- Organisation for Economic Co-operation and Development (OECD). (2023, December 15). Generative artificial intelligence in finance. OECD. https://www.oecd.org/en/publications/generative-artificial-intelligence-in-finance_ac7149cc-en.html

- Penner, T. (2023, November 29). Artificial intelligence for SAP S/4HANA and SAP BTP: A deep dive. SAP Community. https://community.sap.com/t5/enterprise-resource-planning-blogs-by-sap/artificial-intelligence-for-sap-s-4hana-and-sap-btp-a-deep-dive/ba-p/13575469

- SAP. (n.d.). How generative AI will hone banks’ competitive edge. https://www.sap.com/india/insights/viewpoints/how-generative-ai-will-hone-banks-competitive-edge.html