As payment systems evolve to support real-time, cloud-native, and API-driven financial ecosystems, cybersecurity threats have grown exponentially. In this article, we explore the critical cybersecurity priorities for banks, including zero trust architectures, API governance, quantum resistance, and fraud intelligence. A platform approach to security — integrated into the payment modernization journey — is no longer optional, it’s

essential.

Introduction

Modern payment systems like RTP, FedNow, SWIFT gpi, and ISO 20022-based platforms have unlocked faster settlement and richer data exchange. However, they also significantly increase the attack surface for bad actors. The real-time nature of these systems demands faster security decision-making, while open APIs expose new potential entry points, and the richer data offers more enticing targets for cybercriminals. In this dynamic environment, cybersecurity is not just a compliance concern; it’s a core pillar of customer trust and operational resilience.

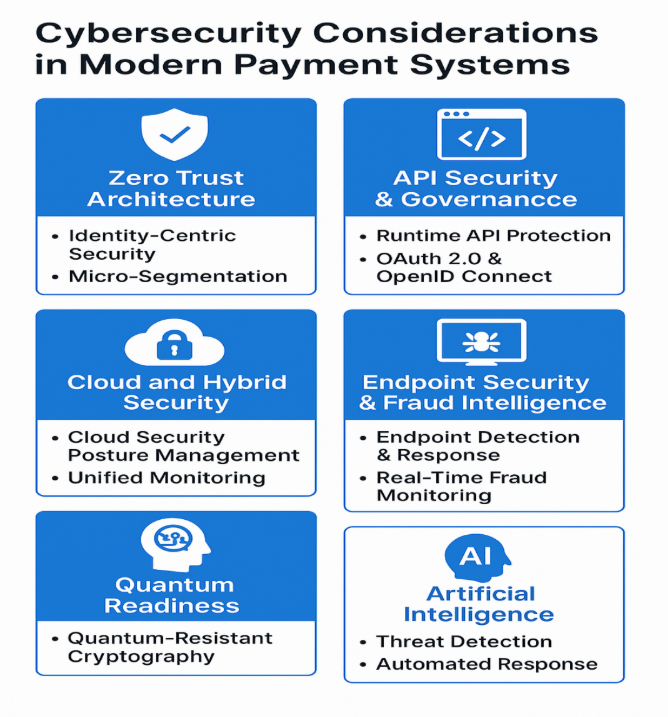

Key Cybersecurity Priorities

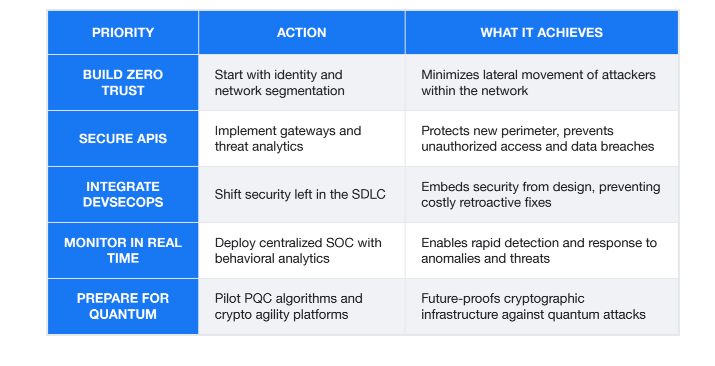

To safeguard these evolving payment ecosystems, banks must focus on several critical cybersecurity priorities:

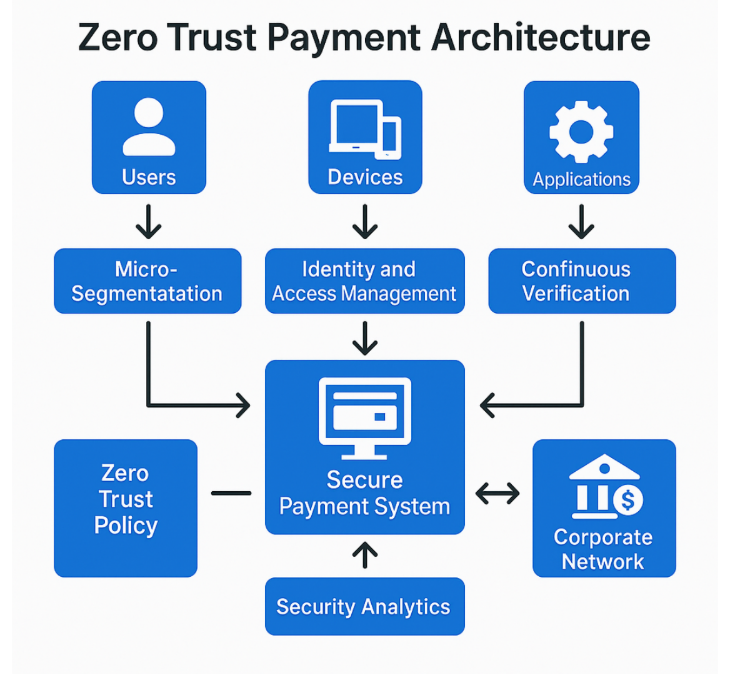

2.1 Zero Trust Architecture

Banks must adopt a zero trust model, operating under the principle of “Never trust, always verify”. This approach is particularly crucial in payments due to the high-value transactions and the constant threat of insider attacks or compromised credentials. Key components

include: Identity-centric security for users and systems Micro-segmentation of payment services to contain breaches Continuous risk-based authentication for all access attempts

2.2 API Security & Governance

Modern payment platforms increasingly use APIs to interface with FinTechs, core banking systems, and regulators, making them the “new perimeter” of the financial institution. These interfaces must be secured at every layer. Key recommendations include:

- API gateways with throttling and schema validation to control access and data formats

- OAuth2.0 & OpenID Connect for robust identity and access management

- Runtime API anomaly detection to identify and block suspicious behavior instantly

2.3 Secure Real-Time Messaging (RTP, ISO 20022, SWIFT)

The speed and volume of real-time payments demand high-throughput and low-latency security measures, as traditional, slower security checks are often insufficient. Best practices involve:

- TLS 1.3 with mutual authentication for secure communication channels

- Message integrity and non-repudiation via digital signatures to ensure authenticity

and prevent tampering - Payload inspection for malware and data leakage within message content

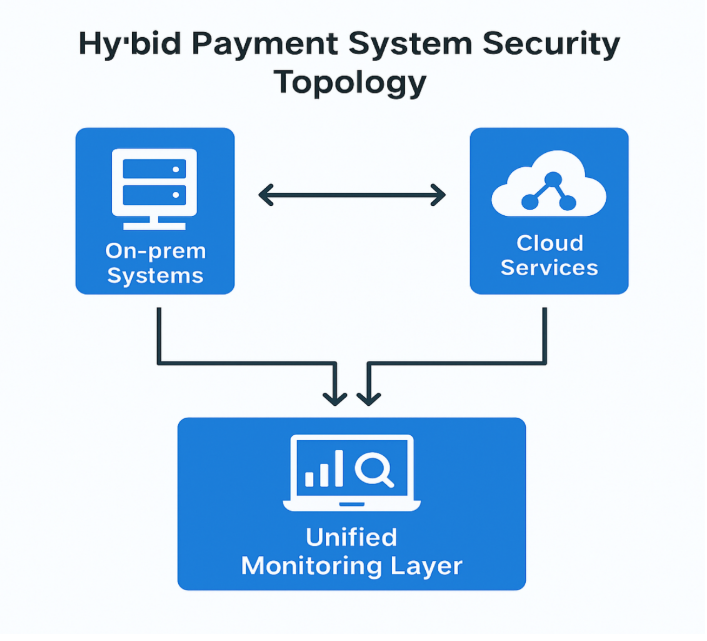

2.4 Cloud and Hybrid Security

As banks increasingly leverage hybrid and public cloud environments for payment infrastructure, integrating cloud-native security with on-premise controls is paramount. Unique risks include data residency, the shared responsibility model, and misconfigurations. Security measures include:

- CSPM (Cloud Security Posture Management) to continuously monitor and improve security configurations

- Secrets management and key rotation to protect sensitive credentials in cloud environments

- SIEM (Security Information and Event Management) integration across the hybrid stack for unified visibility

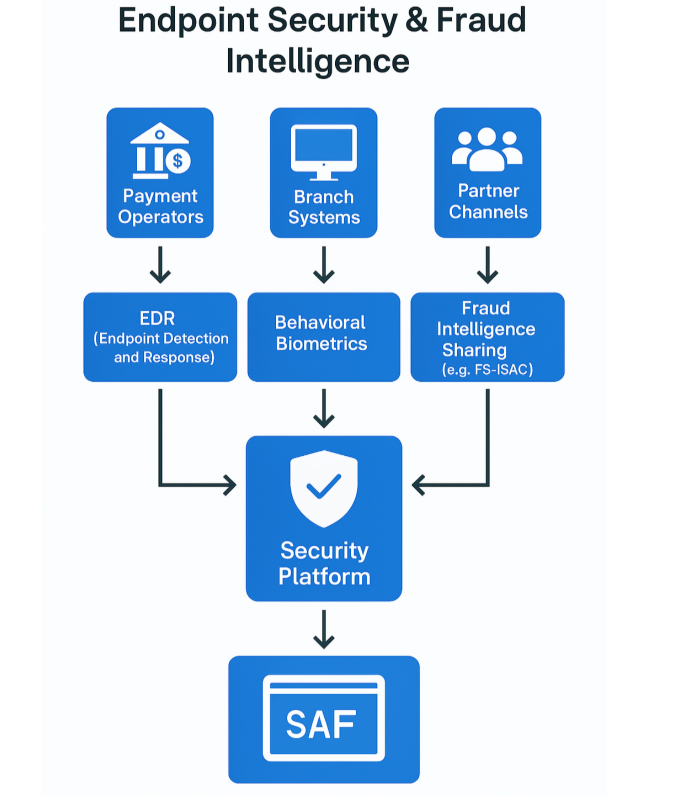

2.5 Endpoint Security & Fraud Intelligence

Payment operators’ workstations, branch systems, and partner channels are common entry points for attackers and are often exploited in payment fraud schemes. Robust endpoint security and shared intelligence are therefore paramount. What to deploy:

- EDR (Endpoint Detection and Response) for continuous monitoring and rapid response to threats.

- Behavioral biometrics to authenticate users based on their unique patterns reducing fraud.

- Real-time fraud intelligence sharing (e.g., via FS-ISAC) to learn from and protect against merging threats across the industry

2.6 Quantum Readiness

The looming threat of quantum computing, capable of breaking current RSA and ECC- based cryptography, means banks must start evaluating quantum-resistant algorithms now. The urgency of starting this evaluation in 2023, even if the quantum threat feels distant, is due to the long transition times required for re-tooling cryptographic infrastructure across global payment systems. NIST PQC finalists like Kyber and Dilithium

are key candidates for evaluation.

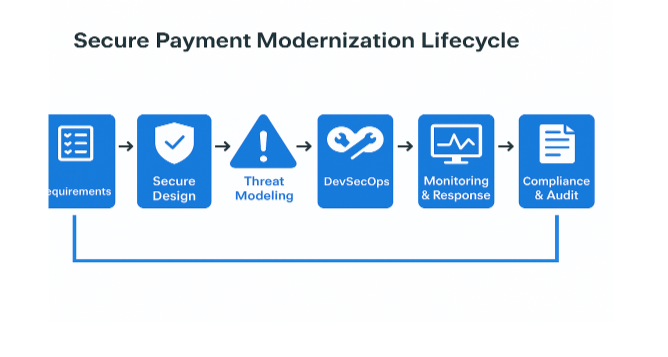

Integrating Cybersecurity into the Payment Modernization Lifecycle

Security should not be an afterthought bolted on at the end of the development process; it must be embedded from design to delivery. This “security-by-design” approach, often termed DevSecOps, prevents costly retroactive fixes and ensures security is a fundamental property of the system. This involves cross-functional teams and dedicated “security champions” within development.

Regulatory Compliance and Global Mandates

The regulatory landscape around cybersecurity in payments is rapidly evolving. Compliance is moving beyond simple checklists to demand adaptive cybersecurity maturity models from banks. Key considerations include:

SWIFT CSCF: Enforced annually, pushing banks to implement a strong baseline of security controls.

ISO 20022: The richer data provided by ISO 20022 messages inherently carries more compliance risk, as institutions must ensure this detailed information is accurately screened for AML/CFT purposes and securely handled for data privacy.

DORA (EU): The Digital Operational Resilience Act imposes stringent requirements for operational resilience for financial entities, pushing for robust incident response and third- party risk management.

Banks must move from checklist compliance to adaptive cybersecurity maturity models.

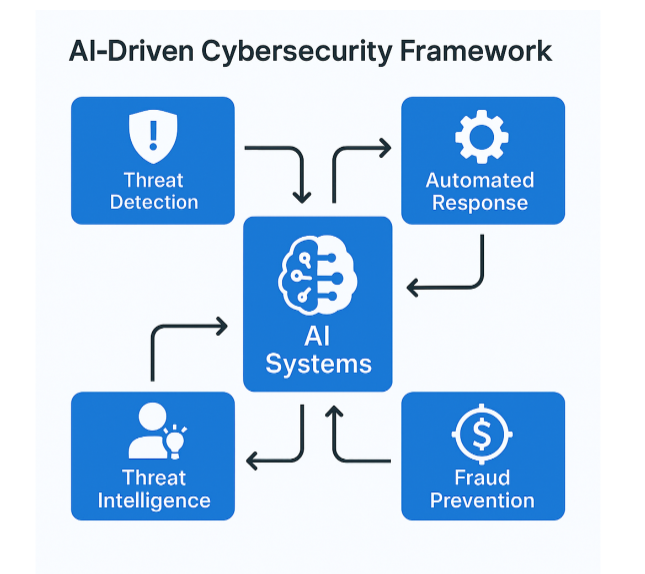

The Role of AI in Cybersecurity

Artificial Intelligence is fast becoming a double-edged sword in cybersecurity. While attackers leverage AI for sophisticated deepfakes, automated phishing, and polymorphic malware, defenders are increasingly using it for anomaly detection, automated response, and threat intelligence correlation. Banks should strategically invest in:

- ML-based anomaly detection to identify subtle threats in vast datasets that human analysts might miss

- AI-driven SOAR (Security Orchestration, Automation, and Response) platforms to accelerate response times and reduce manual effort

- Natural Language Processing (NLP) for analyzing fraud communications and intelligence feeds

Challenges Ahead

Despite the clear path forward, banks face significant hurdles:

Legacy systems and siloed security tooling: Existing infrastructure can hinder holistic visibility and create vulnerable attack surfaces, making integration complex and expensive.

Shortage of skilled cybersecurity professionals: The global talent gap means overworked teams, delayed security enhancements, and difficulty keeping pace with rapidly evolving threats.

Increasing supply chain and third-party risk: As payment ecosystems become more interconnected through FinTech partnerships and cloud service providers, the security posture of third parties directly impacts a bank’s overall risk profile.

Recommendations for Banks

To navigate these challenges and secure modern payment systems, banks should prioritize the following actions:

Conclusion

Modern payments are fast, open, and programmable — and your security posture must reflect this agility and robustness. As cyber threats continue to evolve in sophistication and scale, a platform-based, embedded cybersecurity strategy is the only way banks can

scale securely into the future. By prioritizing these key areas, financial institutions can not only meet compliance demands but also build genuine trust and resilience in the increasingly complex world of digital payments.

About the Author :

Abhishek Gupta is a seasoned technology leader with over 20 years of industry experience, currently serving as Senior Vice President at Bank of America. He specializes in wire payments and real-time payment systems, with deep expertise in modernizing legacy infrastructures. Abhishek has led large-scale payment platform transformations, including ISO 20022 adoption, cloud migration, and API-first architectures. His work focuses on building scalable, secure, and interoperable solutions for the future of banking.